Check the details about the States With No Income Tax in USA: How Do They Raise Money for Public Services? here. With no taxation, how are the citizens living in the region? How is the funding for the construction of the schools, buildings, and other institutions imposed? How is the funding managed? The complete details about the States With No Income Tax in USA are shared in this article.

Contents

States With No Income Tax in USA

Taxes are an unavoidable part of life. There are certain federal taxes that are to be paid by all citizens across the country. There are many other state taxes that are imposed bae on the cost of living and the expenditure in the state.

On average, Americans pay around 8.8 per cent of federal taxes every year. While topping the state taxes, the calculation will rise to 13.5 per cent. The residents of California are the highest taxpayers. There are certain states with a taxation limit of 0 per cent.

Important links

Comparison of States with no income tax

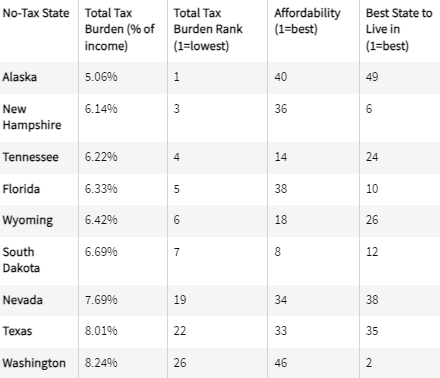

Every state has a budget to manage the programming in the region. As of late 2023, there were 9 states that had 0 per cent of the tax returns in their regions. The states include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Living in a state with no income tax is better for the Americans.

Has any progression been made in the facilities of these states? There are many doubts that have been raised against the will of not having the tax returns. The state does not add the income tax for the resident as a whole. They have certain different ideas for getting the public’s return.

How Do They Raise Money for Public Services?

The nine states do not have any personal income taxes imposed. However, they receive funds from different taxes credited to commercial or personal supplies.

Property Taxes: These states will include tax returns in different areas, such as property taxes, which are only paid by the homeowners of the resident. The rental or the agreement requires not to pay the amount. h taxes are paid to the local authorities itself.

Sales Taxes: The sales tax is added to the purchase of goods and services. The prices are marked by the local government and will be paid directly to them. The average state charges 5 per cent of the goods and sales taxes.

Hotel and tourism taxes: Some states are popular among tourists and have several tax credits for tourism, monuments, and hotel and business purposes. The state has no sales or state taxes imposed.

States and its Taxes

Alaska

The local tax burden on the residents of Alsaka is 5.06 per cent. This is the lowest in all the 50 states. The resident of Alaska has been receiving the payment through the Alaska Permanent and Corp. The state manages the funding for the production of the mineral and the fuels. The per capita divided amount was $13,642.

Florida

The total tax burden in Florida is 6.33 per cent. The state is famous among retirees for its poor retirement life. The state’s lowest expenditure on educational taxation with a capital value of $10401. The spending capital on health care is $8076, which is $3 more than the average annual amount.

Nevada

The total tax burden of Nevada is 7.69 per cent. The state relies heavily on sales taxes from groceries to h4 clothing. They also have major taxes on alcohol, gambling, hotels, and casinos. The state has a history of spending less on the education and healthcare sectors.

South Dakota

The total tax burden of South Dakota is 6.69 per cent. The state receives the taxes on alcohol and cigarettes. They also receive high returns from property taxes paid in Lakota Sioux and the Black Hills. There are many credit cards and insurance companies in the United States that are responsible for managing tax returns.

Texas

The total tax burden of Texas is 8.01 per cent. Texas relies on sales and excise taxes for the tax credits. Property taxes are also quite high, and expenditure is lower. The authorized spends the capital of $11,005 on education and $6,998 on the healthcare sector.

Washington

The total tax burden in Washington is 8.24 per cent. The residents pay the tax return for the sales, people, and gasoline. The authorized spends the capital of $15,570 on education and $7,913 on the healthcare sector.

Wyoming

The total tax burden in Wyoming is 6.42 per cent. The state is the second-largest populated region in the country. The tax burden includes the property, income, sales, and excise taxes. There are many corporate firms in the region that pay excess returns for commercial spaces and the use of resources.

Tennessee

The total tax burden of Tennessee is 6.29 per cent. The stage is involved in major investments and stick marketing. The educational spending of the state’s capital is $10,507, and $9,336 for the healthcare sector. The state has not received the official letter grade for the maintenance of the infrastructure.

New Hampshire

The total tax burden of New Hampshire is 6.14 per cent. The region does not have tax credits but has tax dividends. No sales taxes are imposed, but there is a huge capital for the excise tax, including alcohol and other beverages. The property tax rate is 1.86 per cent.